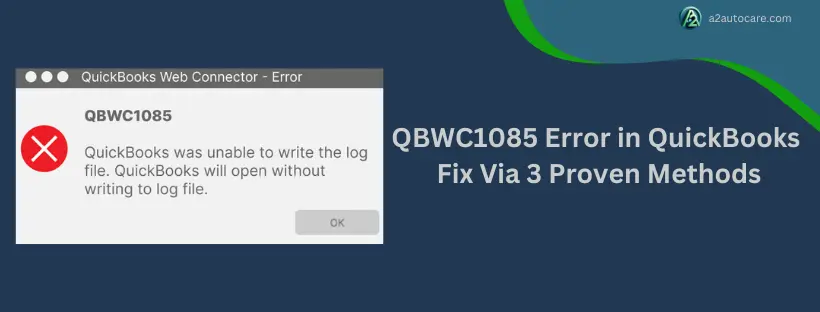

How to Troubleshoot and Eliminate QBWC1085 Error in QuickBooks

When the QuickBooks Web Connector, a tool that helps with connectivity with third-party apps, is unable to access its log file because of corruption or incorrect setup, the QBWC1085 issue in QuickBooks appears. "Unable to write to the log file" is one of the messages that may appear when this error occurs. Data communication between QuickBooks and linked apps is disrupted because the file is either corrupted or unavailable.

Renaming or deleting the log file (QWCLOG.TXT) will enable the Web Connector to create a new log file, which is the first step in troubleshooting this issue. For users who don't use third-party integrations, turning off the Web Connector might be a good fix if the issue continues. Compatibility problems that are triggering the error can be fixed by reinstalling the Web Connector or updating third-party apps.

For More : https://a2autocare.com/article/fix-quickbooks-web-connector-error-qbwc1085/

When the QuickBooks Web Connector, a tool that helps with connectivity with third-party apps, is unable to access its log file because of corruption or incorrect setup, the QBWC1085 issue in QuickBooks appears. "Unable to write to the log file" is one of the messages that may appear when this error occurs. Data communication between QuickBooks and linked apps is disrupted because the file is either corrupted or unavailable.

Renaming or deleting the log file (QWCLOG.TXT) will enable the Web Connector to create a new log file, which is the first step in troubleshooting this issue. For users who don't use third-party integrations, turning off the Web Connector might be a good fix if the issue continues. Compatibility problems that are triggering the error can be fixed by reinstalling the Web Connector or updating third-party apps.

For More : https://a2autocare.com/article/fix-quickbooks-web-connector-error-qbwc1085/

How to Troubleshoot and Eliminate QBWC1085 Error in QuickBooks

When the QuickBooks Web Connector, a tool that helps with connectivity with third-party apps, is unable to access its log file because of corruption or incorrect setup, the QBWC1085 issue in QuickBooks appears. "Unable to write to the log file" is one of the messages that may appear when this error occurs. Data communication between QuickBooks and linked apps is disrupted because the file is either corrupted or unavailable.

Renaming or deleting the log file (QWCLOG.TXT) will enable the Web Connector to create a new log file, which is the first step in troubleshooting this issue. For users who don't use third-party integrations, turning off the Web Connector might be a good fix if the issue continues. Compatibility problems that are triggering the error can be fixed by reinstalling the Web Connector or updating third-party apps.

For More : https://a2autocare.com/article/fix-quickbooks-web-connector-error-qbwc1085/

0 Commenti

0 condivisioni