Debt Collection Software Market Forecast 2025-2033: Share, Size, Trends

Global Debt Collection Software Industry: Key Statistics and Insights in 2025-2033

Summary:

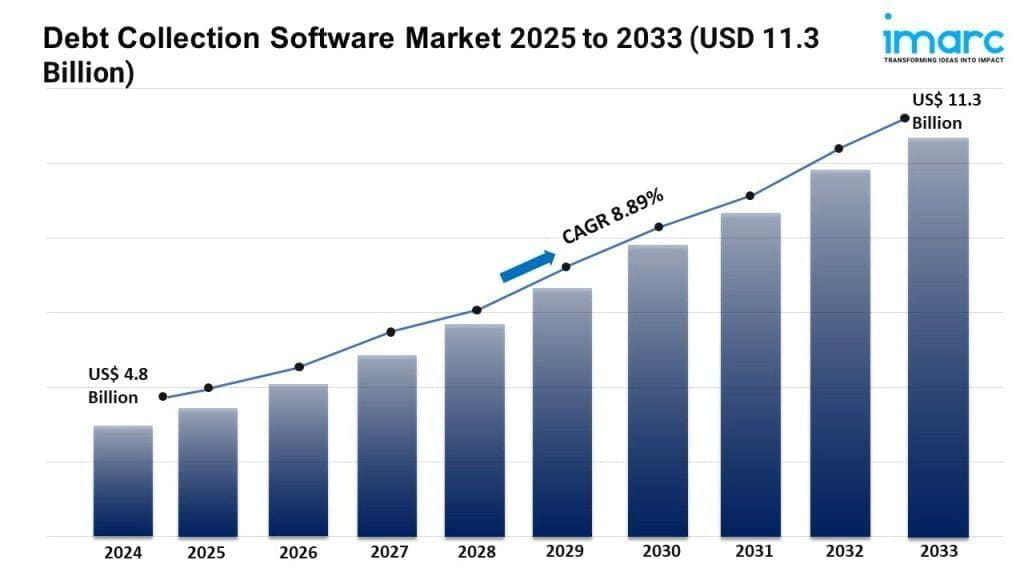

- The global debt collection software market size reached USD 4.8 Billion in 2024.

- The market is expected to reach USD 11.3 Billion by 2033, exhibiting a growth rate (CAGR) of 8.89% during 2025-2033.

- North America leads the market, accounting for the largest debt collection software market share.

- As digital payments rise, transaction volumes are increasing sharply. Rising debt calls for better tools. Creditors need easy ways to track and recover their money. Banks, collectors, and lenders want systems that can adapt.

- They need to manage their growing accounts and boost profits. As unpaid debts are on the rise, efficient management is more crucial than ever.

- The shift to digital technology in the financial sector requires businesses to use smart software, making debt collection easier.

- When efficiency and effectiveness combine, companies change the way they manage their financial obligations.

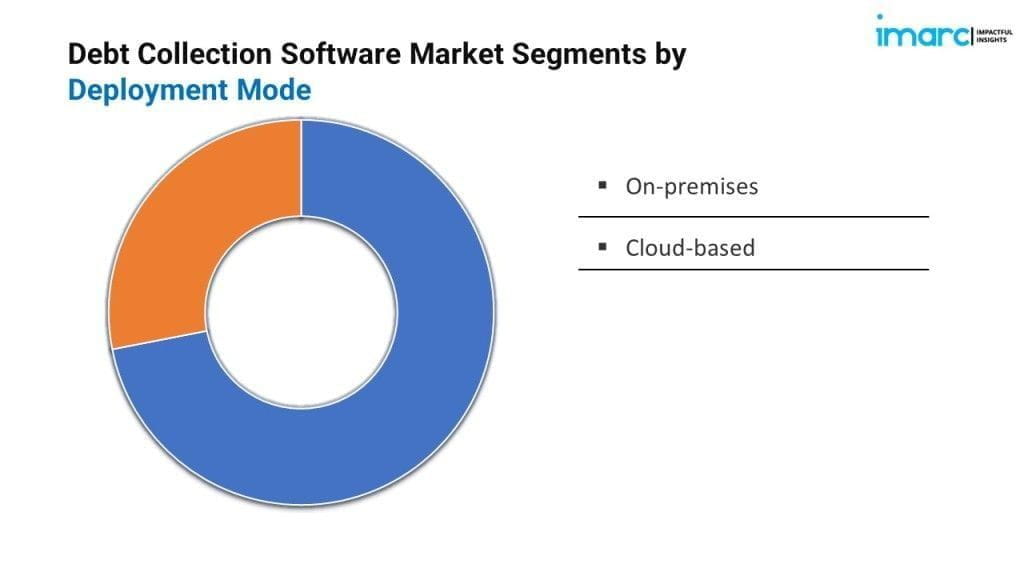

- Businesses prefer on-premises solutions for their customization and easy integration. This popularity has made these systems the market leaders, offering unmatched flexibility.

- Many organizations tailor software to fit their unique needs, which has led to its widespread use across various industries.

Grab a sample PDF of this report: https://www.imarcgroup.com/debt-collection-software-market/requestsample

Industry Trends and Drivers:

- Growing Adoption of Digital Payments

With the rise of digital payments, the volume of transactions is increasing significantly. This leads to more debt accounts, as there is often a delay or default in payments. This situation requires debt collection software to manage and recover these outstanding debts efficiently. Digital payments offer various channels, such as credit and debit cards, mobile wallets, online banking, and electronic fund transfers (EFTs). Debt collection software integrates with these payment channels, giving creditors and collection agencies the flexibility to accept payments from debtors through their preferred method. This approach helps speed up debt recovery.

- Increasing Debt Levels

With a larger volume of outstanding debts, financial institutions, collection agencies, and other creditors need efficient tools to manage and collect these debts effectively. Debt collection software automates and streamlines processes, enabling organizations to handle a higher volume of accounts more efficiently. As debt portfolios become more complex due to different debt types and debtor profiles, organizations look for smart solutions to manage these challenges. Debt collection software offers features like segmentation, predictive analytics, and customizable workflows to meet the diverse needs of creditors.

- Technological Advancements

Advanced automation features simplify repetitive tasks like sending reminders, scheduling follow-ups, and updating account information. By automating these tasks, debt collection software boosts efficiency, reduces manual errors, and frees up resources for more complex work. Additionally, technological advancements let debt collection software enhance communication with debtors across multiple channels, including email, SMS, voice calls, and chatbots. This multi-channel approach improves debtor engagement, enhances user experience, and increases the chances of successful debt recovery.

The debt collection software market forecast offers insights into future opportunities and challenges, drawing on historical data and predictive modeling.

Debt Collection Software Market Report Segmentation:

By Component:

- Software

- Services

Software represents the largest segment due to the increasing digitization of financial processes prompting businesses to adopt software solutions to manage their debt collection more efficiently.

By Deployment Mode:

- On-premises

- Cloud-based

On-premises account for the majority of the market share as they offer customizable features and integration capabilities tailored as per specific organizational needs, providing a level of flexibility that appeals to many businesses.

By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America enjoys the leading position in the debt collection software market on account of a mature and highly developed financial services industry, including banking, lending, and credit card companies, which generate significant volumes of debt requiring collection.

Top Debt Collection Software Market Leaders:

The debt collection software market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

- AgreeYa.com

- Chetu Inc.

- Debtrak

- EbixCash Financial Technologies

- Experian Information Solutions Inc

- Fair Isaac Corporation

- Katabat Corporation (Ontario System)

- Nucleus Software Exports Ltd.

- Pegasystems Inc.

- Seikosoft

- TietoEVRY

- TransUnion LLC

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness