What You Need To Know Prior To Getting A Pay Day Loan

Posted 2021-09-17 13:58:24

0

0

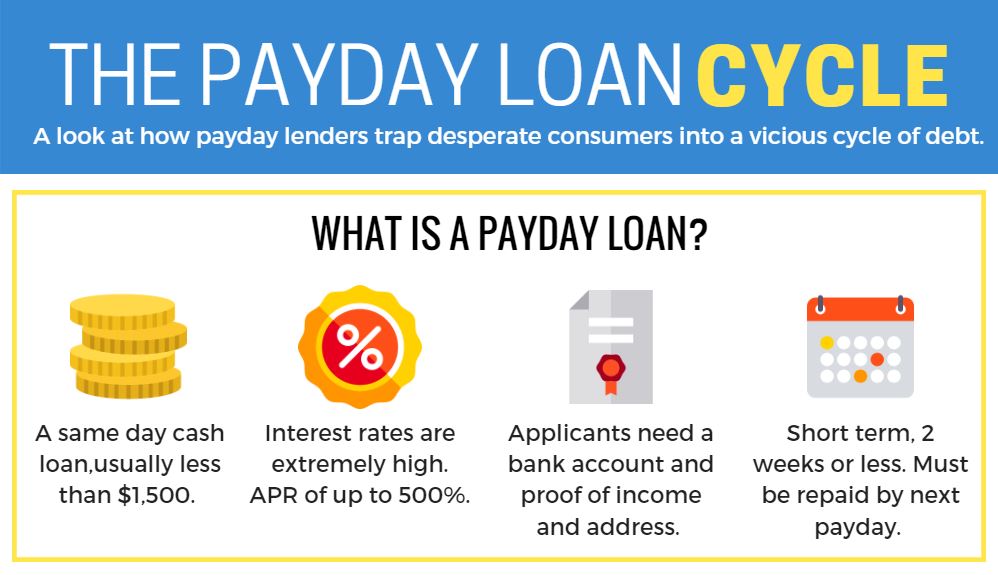

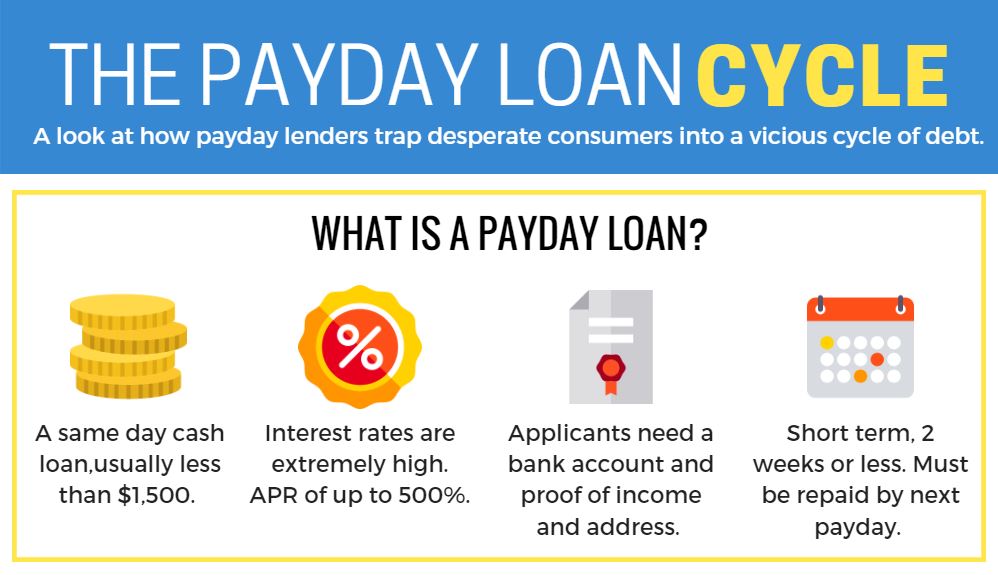

If you are up against fiscal issues, the globe can be a very cold position. Should you are in need of a brief infusion of money and not positive the best places to transform, the next article offers noise guidance on online payday loans and how they might assist. Consider the information and facts very carefully, to see if this option is for you.

When you are thinking about a short expression, payday advance, tend not to borrow any more than you must. Pay day loans need to only be used to allow you to get by inside a pinch and not be used for added dollars from the wallet. The interest levels are far too substantial to obtain any more than you undoubtedly need.

When you have to use a pay day loan because of an urgent situation, or unanticipated event, understand that many people are put in an negative place in this way. Should you not use them responsibly, you could find yourself within a pattern which you cannot get out of. You could be in debt on the pay day loan business for a very long time.

Study a variety of pay day loan companies well before settling using one. There are various businesses on the market. Many of which can charge you critical monthly premiums, and costs in comparison with other options. In reality, some could have short term special offers, that actually make a difference in the price tag. Do your perseverance, and ensure you are acquiring the best deal probable.

If you want to give your checking account number, will not fret, this is a standard portion of the transaction. Lots of people end up not getting this loan because they are unpleasant with disclosing this data. As a result the company you borrow from comfortable that you could pay out it again.

Be sure you consider your alternatives. Some firms will provide you with significantly better terms than another company will. This is a great way to keep from investing greater than necessary. The real key will be your credit history as well as the loan amount you desire. By finding the time to check out distinct financial loan options, you will be confident to find the best feasible package.

Usually read through each of the stipulations linked to a payday loan. Identify each reason for interest, what each achievable fee is and the way much each one is. You would like an emergency fill bank loan to help you from your current conditions returning to in your feet, however it is feasible for these circumstances to snowball above several paychecks.

Compile a listing of every personal debt you have when getting a payday loan. Including your medical charges, credit card bills, home loan repayments, and a lot more. Using this collection, you may decide your monthly expenses. Do a comparison in your regular monthly cash flow. This should help you make certain you make the best achievable choice for paying back the debt.

Write down your payment thanks days. When you get the cash advance, you should shell out it back again, or at least make a transaction. Even when you neglect whenever a settlement date is, the corporation will make an effort to withdrawal the total amount through your checking account. Listing the dates will allow you to keep in mind, allowing you to have no problems with your lender.

Those searching to get a pay day loan can be wise to benefit from the very competitive market place that is present among creditors. There are many diverse loan companies on the market that some will consider to provide far better deals as a way to have more enterprise. Make it a point to get these provides out.

If you discover oneself commonly counting on payday cash loans just to make do, it could be a smart decision to employ a financial debt counselling services as a way to discover ways to far better control your hard earned money. If you misuse a cash advance, it could be a cycle that may be challenging to endure.

To save cash towards your payday advance, consider marketing products at home you never ever use any further through websites like eBay and Amazon. https://pbase.com/topics/reasontenor07/pick_intelligently_when_it_c Although you may not feel you have many useful things to sell, you almost certainly do. Examine your publication series, cd collection, and also other electronic devices. Even when you is only able to create a couple hundred bucks, it might nonetheless assist.

To get a pay day loan, get in touch with a nearby service provider. It certainly is convenient to go online and send the online type, but phoning could produce superior final results. You will get your queries answered and have the part of mind that you simply completely understand each of the facets of the money.

Find out more about the several types of pay day loans. Some financial loans are offered to people who have a poor credit rating or no present credit score although some payday cash loans are for sale to army only. Perform a little research and make certain you select the money that matches your requirements.

Use pay day loans only for money urgent matters. One of many benefits of a cash advance is that it enables you to continue to be personal-ample and take care of your own personal finances in individual. If you have to use the amount of money from loved ones or good friends, then you should reveal your financial situation, which many people prefer to keep to them selves.

When you indicator your pay day loan deal, you're locked in. That's why it's significant to check out charges and fees upfront. As much as you really should receive the procedure done easily, these fees causes it to become significantly more challenging to repay the loan. Make sure you will pay curiosity charges along with the real sum of money you loaned.

Ensure you do have a comprehensive idea of payday cash loans prior to signing any commitment. It's a quick financial loan approach, and following acceptance, you will have your funds in round the clock or a lot less. Then you must expect to pay back the loan.

For anyone seeking to take out a pay day loan, they must highly think about trying to find individual personal loans initially. When you have great credit history and a strong history along with your financial institution, you just might have a personal personal loan in a far lower interest, with a great deal more time to cover it rear.

Ensure you keep a close eyesight on your credit track record. Aim to check it no less than yearly. There may be problems that, can drastically problems your credit. Getting less-than-perfect credit will in a negative way impact your rates of interest on your pay day loan. The better your credit history, the less your interest rate.

This article has supplied you with a bit of fundamentals on pay day loans. Make sure you evaluate the details and evidently understand it before making any financial decisions with regards to a cash advance. These alternatives can help you, when they are used correctly, but they have to be comprehended to avoid monetary hardship.

When you are thinking about a short expression, payday advance, tend not to borrow any more than you must. Pay day loans need to only be used to allow you to get by inside a pinch and not be used for added dollars from the wallet. The interest levels are far too substantial to obtain any more than you undoubtedly need.

When you have to use a pay day loan because of an urgent situation, or unanticipated event, understand that many people are put in an negative place in this way. Should you not use them responsibly, you could find yourself within a pattern which you cannot get out of. You could be in debt on the pay day loan business for a very long time.

Study a variety of pay day loan companies well before settling using one. There are various businesses on the market. Many of which can charge you critical monthly premiums, and costs in comparison with other options. In reality, some could have short term special offers, that actually make a difference in the price tag. Do your perseverance, and ensure you are acquiring the best deal probable.

If you want to give your checking account number, will not fret, this is a standard portion of the transaction. Lots of people end up not getting this loan because they are unpleasant with disclosing this data. As a result the company you borrow from comfortable that you could pay out it again.

Be sure you consider your alternatives. Some firms will provide you with significantly better terms than another company will. This is a great way to keep from investing greater than necessary. The real key will be your credit history as well as the loan amount you desire. By finding the time to check out distinct financial loan options, you will be confident to find the best feasible package.

Usually read through each of the stipulations linked to a payday loan. Identify each reason for interest, what each achievable fee is and the way much each one is. You would like an emergency fill bank loan to help you from your current conditions returning to in your feet, however it is feasible for these circumstances to snowball above several paychecks.

Compile a listing of every personal debt you have when getting a payday loan. Including your medical charges, credit card bills, home loan repayments, and a lot more. Using this collection, you may decide your monthly expenses. Do a comparison in your regular monthly cash flow. This should help you make certain you make the best achievable choice for paying back the debt.

Write down your payment thanks days. When you get the cash advance, you should shell out it back again, or at least make a transaction. Even when you neglect whenever a settlement date is, the corporation will make an effort to withdrawal the total amount through your checking account. Listing the dates will allow you to keep in mind, allowing you to have no problems with your lender.

Those searching to get a pay day loan can be wise to benefit from the very competitive market place that is present among creditors. There are many diverse loan companies on the market that some will consider to provide far better deals as a way to have more enterprise. Make it a point to get these provides out.

If you discover oneself commonly counting on payday cash loans just to make do, it could be a smart decision to employ a financial debt counselling services as a way to discover ways to far better control your hard earned money. If you misuse a cash advance, it could be a cycle that may be challenging to endure.

To save cash towards your payday advance, consider marketing products at home you never ever use any further through websites like eBay and Amazon. https://pbase.com/topics/reasontenor07/pick_intelligently_when_it_c Although you may not feel you have many useful things to sell, you almost certainly do. Examine your publication series, cd collection, and also other electronic devices. Even when you is only able to create a couple hundred bucks, it might nonetheless assist.

To get a pay day loan, get in touch with a nearby service provider. It certainly is convenient to go online and send the online type, but phoning could produce superior final results. You will get your queries answered and have the part of mind that you simply completely understand each of the facets of the money.

Find out more about the several types of pay day loans. Some financial loans are offered to people who have a poor credit rating or no present credit score although some payday cash loans are for sale to army only. Perform a little research and make certain you select the money that matches your requirements.

Use pay day loans only for money urgent matters. One of many benefits of a cash advance is that it enables you to continue to be personal-ample and take care of your own personal finances in individual. If you have to use the amount of money from loved ones or good friends, then you should reveal your financial situation, which many people prefer to keep to them selves.

When you indicator your pay day loan deal, you're locked in. That's why it's significant to check out charges and fees upfront. As much as you really should receive the procedure done easily, these fees causes it to become significantly more challenging to repay the loan. Make sure you will pay curiosity charges along with the real sum of money you loaned.

Ensure you do have a comprehensive idea of payday cash loans prior to signing any commitment. It's a quick financial loan approach, and following acceptance, you will have your funds in round the clock or a lot less. Then you must expect to pay back the loan.

For anyone seeking to take out a pay day loan, they must highly think about trying to find individual personal loans initially. When you have great credit history and a strong history along with your financial institution, you just might have a personal personal loan in a far lower interest, with a great deal more time to cover it rear.

Ensure you keep a close eyesight on your credit track record. Aim to check it no less than yearly. There may be problems that, can drastically problems your credit. Getting less-than-perfect credit will in a negative way impact your rates of interest on your pay day loan. The better your credit history, the less your interest rate.

This article has supplied you with a bit of fundamentals on pay day loans. Make sure you evaluate the details and evidently understand it before making any financial decisions with regards to a cash advance. These alternatives can help you, when they are used correctly, but they have to be comprehended to avoid monetary hardship.

Search

Categories

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

Read More

<h1>Bộ Kem Đặc Trị Nám Tàn Nhang Clobetamil G Four In 1</h1>

Sử dụng kem Garnier hàng ngày liên tục từ 4 – 6 tuần, chị em sẽ thấy...

Fortnite's Original Map Returns But as a Skin

In October 2019, Epic Games covered of Season 10 of Fortnite by sending the island into a black...

EAS Systems Market 2021: Industry Size, Regions, Emerging Trends, Growth Insights, Development Scenario, Opportunities, and Forecast By 2027

EAS systems Market Analysis, Trends, Size, and Forecast. EAS systems Market Industry Overview,...

The Core Issues Of Fitting Eyeglasses Online Include Correct Optometry Data

The core issues of fitting the cheapest eyeglasses online include correct optometry data,...

Trực Tiếp Bóng Đá

Xoilac.net cung cấp hệ thống link trực tiếp đa dạng, nhiều hyperlink xem chất lượng cao,...